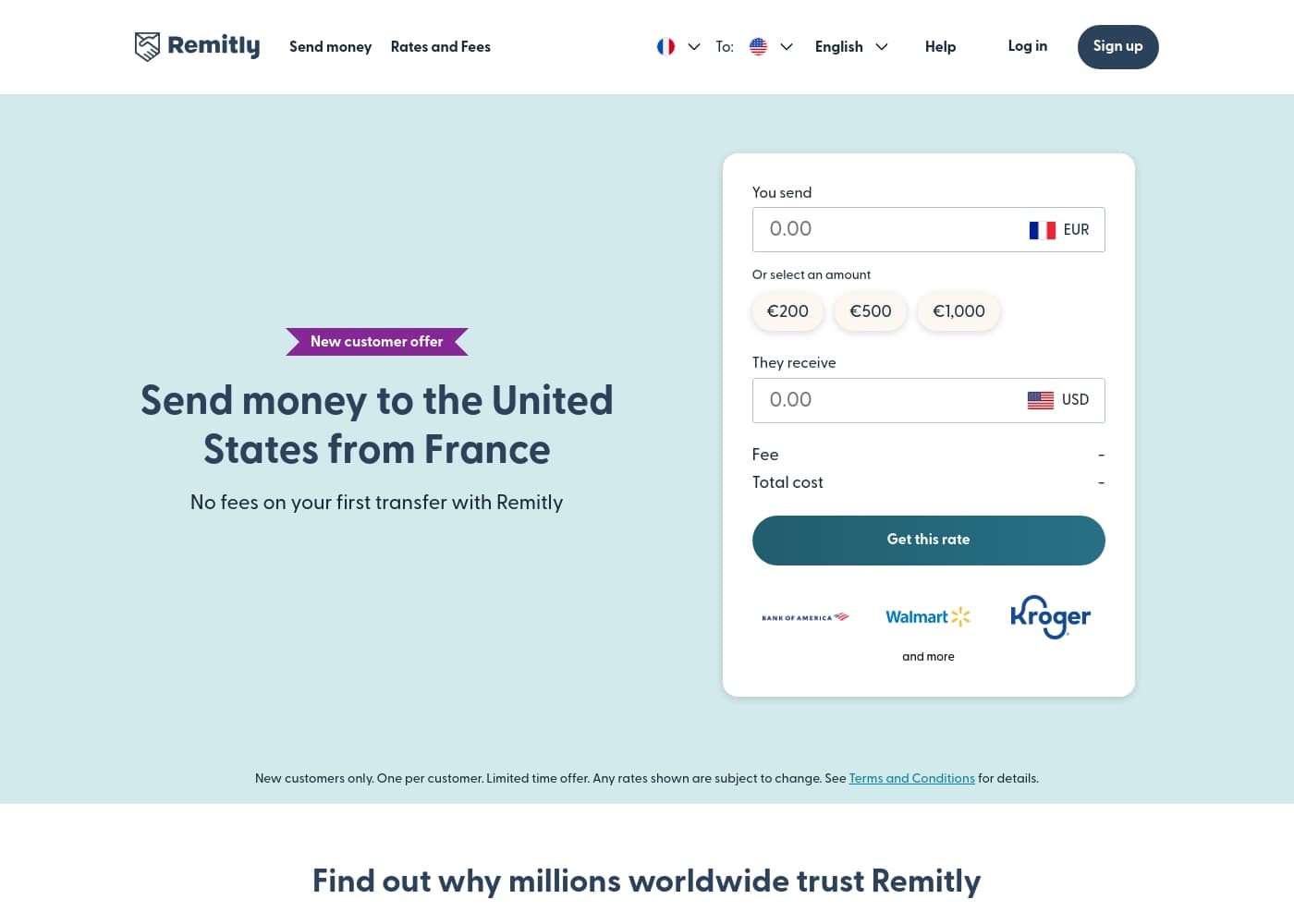

Remitly utilizes a straightforward, transaction-based pricing model. This means you pay variable fees per transfer, depending on factors like speed and destination, but all costs are clearly displayed upfront.

New customers receive a major benefit: no fees on their very first money transfer.

Remitly uses transaction-based pricing, featuring a promotional rate of 0.7463 GBP to 1 USD on the first transfer and waiving the initial transfer fee.

Remitly focuses on transparency, ensuring you know the costs upfront before you send money.

Promotional First Transfer

Price: Not explicitly stated (Transaction fees waived)

Websites Supported: Not explicitly stated

Best For: New customers testing the service

Refund Policy: Not explicitly stated

Other Features:

- No fees on your first transfer.

- Special promotional exchange rate of 0.7463 GBP for 1 USD.

- Worry-free and reliable transfers.

Start your journey with Remitly worry-free. You get to try out the reliable money transfer service without incurring the usual transaction fee. This is a great way to experience Remitly’s speed and dependability before committing to future transfers.

Remitly does not rely on subscription plans, focusing instead on dependable exchange rates and clear pricing for every transaction. While there is no traditional free trial, your first transfer is always free of fees, giving you an excellent opportunity to test the service.